Multi-Location

Business Insights

A generative research study leveraging in-depth interviews to identify high-impact opportunities, ultimately mapping insights & recommendations to roadmaps & workstreams.

Project overview

Opportunity

Allergan Aesthetics made the strategic decision to focus on top-tier accounts (20th percentile) as our primary audience. Most of these accounts are multi-location healthcare practices; however, Allē’s provider experience is largely limited to location-level functionality.

Contribution

As the lead UX Researcher of the Provider I Tribe, I conducted generative (discovery) research via in-depth interviews with Allē customers and internal SMEs, completed a thorough thematic analysis, and produced study artifacts ranging from digestible key insights coupled with video highlights to a comprehensive written report of findings.

Outcome

55+ tracked user insights mapped to relevant workstreams and functional areas, a critical update to sales team protocol catalyzed by root-causes analysis, and a 0→1 Business Insights experience that aims to unlock pivotal capability for 6k multi-location businesses, Allergan Aesthetics’s most productive accounts.

-

UX Research, Product Management, Product Strategy, UX Design, Product Marketing, and Engineering.

-

- Literature review to ground ourselves in what we already know, and what we know we don’t.

- In-depth interviews to uncover the needs and behaviors of multi-location healthcare practices.

- Internal interviews to gain perspective from Allergan Aesthetics sales representatives and practice consultants.

-

Microsoft 365 (Teams, Bookings, Outlook), Google Workspace (Docs, Slides), Dovetail, Miro, Atlassian (Confluence, Jira), Loom

Brand introduction

Allergan Aesthetics, the innovator behind Botox® & Juvéderm®, creates products and technologies that drive the advancement of aesthetic medicine. Allē is a loyalty rewards program that allows consumers to earn points on their Allergan Aesthetics purchases, and gives customers (healthcare practitioners) a suite of tools and features designed to serve their practice’s needs.

The challenge

Last fall, Allergan Aesthetics leadership made the strategic decision to concentrate growth efforts on top-revenue-tier accounts. Healthcare provider accounts in the 80th percentile are predominantly multi-location practices; however, the information architecture of the Allē provider experience is essentially flat, built on the now-outdated notion that single-location practitioners were the primary user. In order to refocus our Product Vision to suit the needs of the crucial multi-location customer segment, we needed to understand their needs and operational structure more holistically and on a much deeper level.

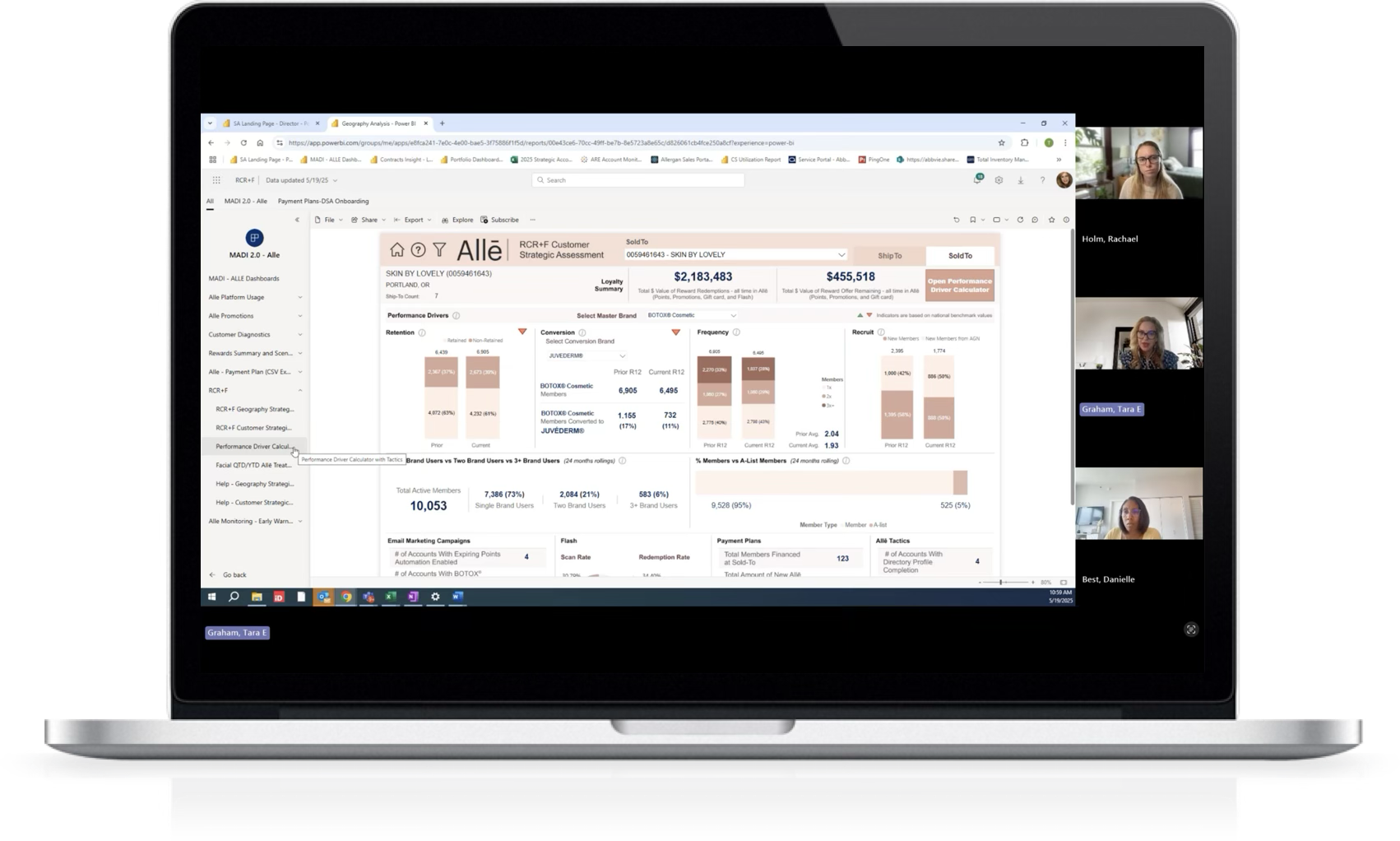

Business-level start page

Business-level functionality is limited to just a few reports, permissions settings, and a single insights widget. All other aspects of the A4B value proposition are only available at the individual location level.

Location-level dashboard

Launching email marketing campaigns, contacting leads, and downloading most reports occur at the location level, meaning duplicative work for multi-location practices, if they’re centrally managed.

By the numbers

To bolster our business case for prioritizing the multi-location experience , the lead Product Manager and I pulled some stats that would ground us in context and help us size the prize. We knew this segment was valuable, but the data still took us by surprise.

$2.6B

multi-location facial aesthetics revenue

81%

of multi-location accounts are top-tier

62%

of revenue comes from multi-location accounts

32K

locations are part of a multi-location business

71%

of top-tier accounts are multi-location

Research plan

Our objective was to uncover gaps between multi-location customer goals and the current experience, and identify high-impact opportunities for Product & UX teams to fulfill those unmet needs. Remote moderated in-depth interviews were the optimal methodology to get us there because we had access to these customers, could turn a qualitative study around in a relatively short period of time, and would best help us achieve our research objectives considering the following:

-

With minimal existing research on the multi-location customer segment, we wanted to explore users’ underlying needs, values, beliefs, and mental models and extract qualitative insights to gain signal.

-

Semi-structured interviews allow for probing or pivoting based on participant responses. This adaptability helps uncover unexpected insights or patterns that structured methods might miss.

-

When participants are able to explain their thought processes or the circumstances that lead them to say/do/think/feel X, we’re able to better understand not just what (X), but the why behind it.

Coordination

In preparation for data collection, I developed the following documentation:

Research brief to anchor stakeholder alignment on objectives, methods, sourcing, timelines, and deliverables

Discussion guide to steer interview moderation and ensure key questions are being addressed in each session.

Dovetail project to begin compiling secondary resources and preparing a space for data collection & analysis.

Recruitment log outlining participant criteria, sampling considerations, outreach, scheduling, and status.

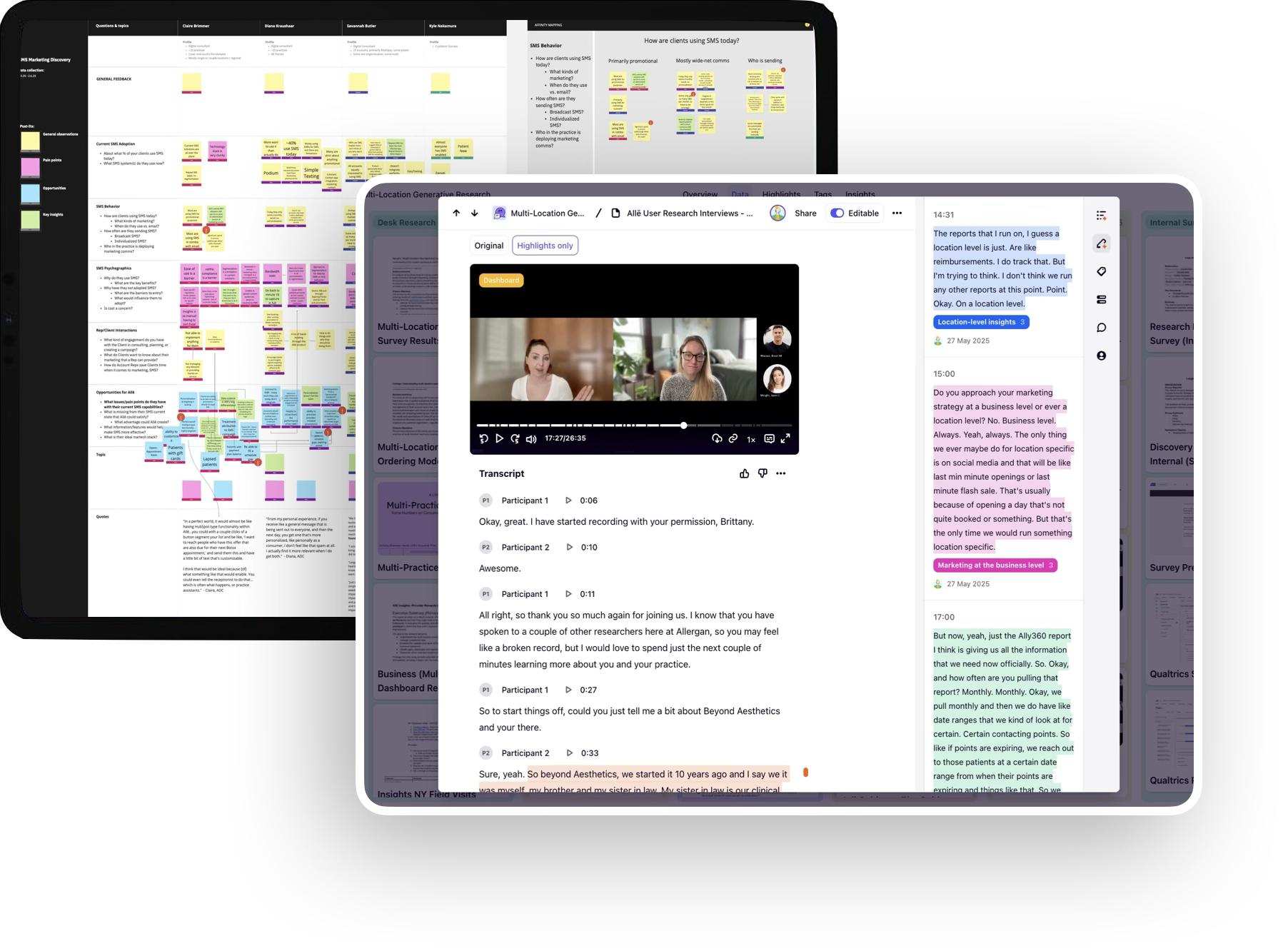

Data collection & thematic analysis

I conducted six 60-minute customer interviews over the course of one week, tactically guiding conversations while holding space for participants to express any top-of-mind experiential feedback. I asked observers to take notes during sessions and invited them to submit pertinent questions via Slack, which I monitored throughout.

Data collection was immediately followed by a thorough thematic analysis, for which I had 328 minutes of video recordings to review & code. I generated 227 tagged datapoints and conducted an affinity diagramming exercise in Miro to sort them into meaningful clusters and assigned categories. I also used Dovetail’s highlight & tagging tools to code & label verbatims and create highlight reels for each theme.

Synthesis & a sample of key insights

My analysis of the interviews produced more than 50 validated user findings. By triangulating critical datapoints to tell a more wholistic story, I synthesized the study results into 10 key insights with supporting annotations - a few samples:

1

Validated the need for business-level visibility & functionality

Multi-location practices largely manage marketing and operations at the business level, citing in part high injector/patient mobility across locations.

“I care about my business as a whole, and sometimes like my Warminster location may be in a slump, but as long as Reading makes up for it, I don't care. I look at my business overall.”

— Multi-location Marketing Manager

2

A business-level dashboard is a highly desirable surface

While specific KPI priorities varied within the sample, business-level insights visibility was unanimously requested.

“I always [prefer to see data for] my entire business… I don't know how representative I am. Maybe you have some national accounts and they would like to see location level. But I would love to see everything on the business level.”

— Multi-location COO

3

Comparing locations is often nuanced & impractical

While location comparisons are helpful in theory, in practice, the comparison is not always reliable or apples to apples.

“One office has 16 providers and one office has two. One office is open five days a week, one office is open three. So while I do look [to compare] sales to sales, I don't hold [locations] hostage against each other.”

— Multi-location Operations Director

Root-cause analysis

One pattern called for immediate attention. During data collection, I began to notice a concerning trend: multi-location customers expressed distrust in their Allē data. In order to illuminate the underlying cause, I leveraged the Five Why's:

“I don’t use Allē much outside of marketing.”

Why? →

“The data doesn’t give me the full picture.”

Why? →

“Because I can’t compare my locations.”

Why? →

“The location-specific data isn’t accurate.”

Why? →

“We only check patients out under one location.”

Why? →

“That’s where my sales rep drops the offer codes I can pass off to patients.”

Uncovered: sales reps often awarded their practices offer codes that practitioners could gift their patients; however, by making these offer codes available for just one location, other locations were forced to check their patients out inaccurately, skewing transaction data and rendering location-location comparisons unreliable. I packaged this insight with supporting evidence and escalated the issue, which led to a universally communicated change in sales team protocol.

Sample of output; insights have been modified for confidentiality.

Findings delivery

I packaged the research findings into several forms to cover the spread from easily digestible resources to a comprehensive written research report. I supplemented written documents with a highlight reel of the most impactful video clips from the sessions, enabling stakeholders to hear feedback directly from customers. Insights were presented to the core project team and tech leadership, then distributed for broader consumption.

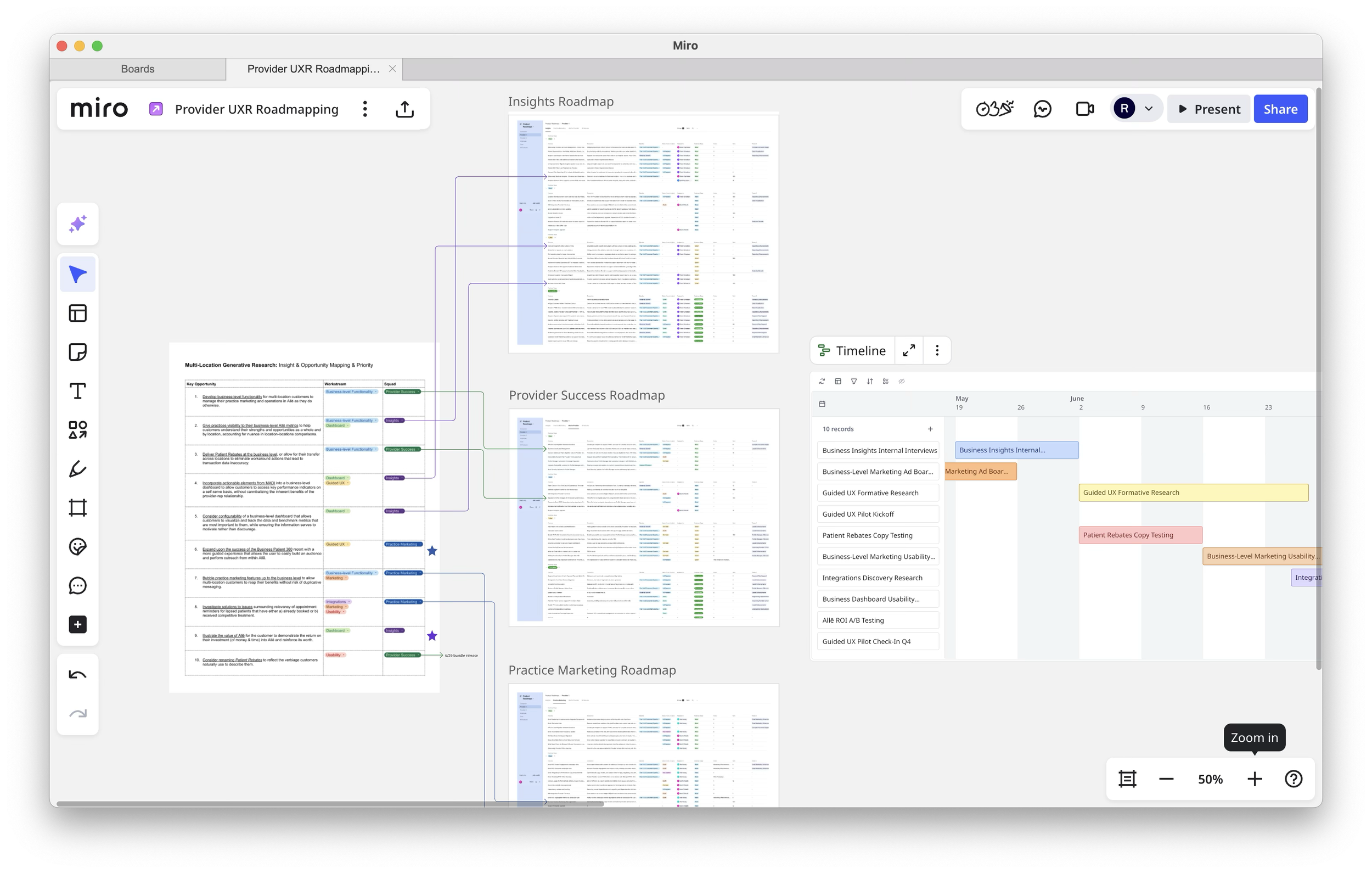

Insights » Action

In collaboration with the product leads of my three squads (Insights, Practice Marketing, and Provider Success), key insights were activated in one of two ways:

Prioritizing and mapping immediately-actionable pain points and opportunities to in-flight or upcoming roadmap items.

Spinning up net-new product/research workstreams to address high-impact opportunities not currently featured on the roadmap.

Emergent workstream: Business-level insights experience

A key insight that surfaced was an underscored need for self-serve data and performance metrics aggregated across practice locations, but further research was needed to sharpen our understanding of what that experience should entail.

Generative insights:

Customers rely heavily on their sales reps for business-level performance analysis today.

Customers need varying degrees of help interpreting their business performance data.

Sales reps help customers set quarterly goals, but there is no uniform tracking method.

→

“How Might We” statements:

How might we enable customers with aggregated data and KPIs on the platform?

How might we help customers understand their metrics and how to improve?

How might we allow customers to track their progress toward their goals?

→

Formative research learning objectives:

What considerations should be made as we design a self-serve analytics experience?

What KPIs does the business need customers to focus on, and actions to take?

What is the content and accompanying narrative of monthly performance reviews?

Formative research

I conducted a series of internal interviews with members of the Allergan Aesthetics sales organization to understand the nature and content of the touchpoints they have with customers today, and for their perspective on what objectives a 0→1 business-level insights experience should satisfy. Learnings directly informed product direction and guided design ideation.

Outcome & impact

This multi-phased research initiative produced the most substantial user insights pertaining to multi-location business accounts in Allergan Aesthetics company history.

Through generative and formative research, I surfaced numerous pivotal insights about the multi-location business customer (a $2.6B segment), uncovered and corrected a data-detrimental practice of sales reps, and laid a foundation of trusted knowledge informing a transformative business-level insights user experience.