Hollister Denim

Shopping Journey

A foundational research study triangulating mixed-methods insights to illuminate untold truths about the Hollister denim shopper, uniting cross-functional teams in empathy for and understanding of a must-win customer segment.

Project overview

Opportunity

Our research indicates that customers want outfit inspiration and style guidance when shopping online for clothes, but our current solutions on product pages are not meeting their needs or the needs of the business.

Contribution

As the lead UX Researcher, I conducted a thorough synthesis of existing resources, identified areas in which we needed to go deeper, conducted omnichannel in-person research, and produced journey maps.

Outcome

A newfound and united understanding of and empathy for a critical customer segment, coupled with rich insights providing a North Star for Product, Design, Marketing, and Merchandising teams.

-

UX Research, Customer Research, Data Analytics, Voice of the Customer

-

- Literature review to compile and synthesize all existing data and establish what we know and what we need to learn. Inputs include:

User interviews

User testing

Focus groups

At-home try-ons

Community surveys

Data analysis

A/B tests

VOC surveys

CS touchpoints

Market analysis

- In-depth interviews to understand the foundational attitudes and needs that drive their behavior

- Contextual inquiry to observe users throughout their entire omnichannel shopping journey

-

Primary research: Miro, Fuel Cycle, Microsoft 365

Secondary research: Sharpr, UserZoom, Qualtrics, Adobe Analytics, Optimizely, InMoment

Brand introduction

Hollister Co. (HCo) is an American lifestyle brand and international teen fashion retailer, owned by Abercrombie & Fitch (A&F) and operator of spin-off brand Gilly Hicks. With stores in 16 countries and a global ecommerce presence, Abercrombie & Fitch and Hollister are among the most recognized clothing brands worldwide.

The challenge

Denim is a top shopping destination for Hollister customers and a must-win category for the brand. But while online sales in other product categories have steadily risen, DTC denim sales lag, with higher rates of return. Several independent research efforts have generated findings on Hollister denim shoppers, but datapoints have not been triangulated across studies to establish a foundational knowledge base. What insights can be uncovered from existing and net-new research to guide and inspire our denim CX strategies?

Research plan

Our research goals were to create a fundamental understanding of the Hollister denim shopper . This would require a multi-method approach in three phases to 1) identify our “known knowns” and “known unknowns,” 2) fill knowledge gaps with primary research, and 3) document the customer journey to enhance empathy and understanding.

1) Extensive literature review

-

Understand the current landscape

Identify known knowns, unknown knowns, and known unknowns

Understand the impact this issue is having on internal teams

-

8 interviews dual-led by UXR and UXD

Product Manager & Product Marketing Manager for each WM for Business product

Sample of Client Success Managers

Product Analytics

Conducted via Google Meet

Note-taking in FigJam

-

Session scheduling

Discussion outline write-up

Collaborative note-taking prep

2) Contextual inquiry

-

Understand what clients need to run their businesses successfully & independently

Uncover underlying desires and expectations that are not being serviced today

Determine how client needs differ between account types and job functions

Learn firsthand about the frustrations and friction points clients have with the current experience

Develop a client hierarchy of analytics needs from must-have to nice-to-have

-

In-depth user interviews

6 WM clients, active users of WM product suite

Sample of single-location & multi-location business operators

Sample of various job functions including business owner, operations manager, and marketing manager

Conducted via UserTesting

Note-taking in UserTesting & FigJam

-

Research brief documentation

Sampling & recruitment

Session scheduling

Discussion guide write-up

Session setup & observer invites

Collaborative note-taking prep

Analysis & mapping plan

Reporting, publishing, & distribution protocol

3) Journey mapping

-

Test designs iteratively for optimal comprehension and usability

Continuously refine designs based on feedback from test participants

Document any limitations or constraints of the experience to reference during post-release evaluation

-

Moderated user tests

8 WM clients, active users of WM product suite

Sample of single-location & multi-location business operators

Sample of various job functions including business owner, operations manager, and marketing manager

Conducted via UserTesting

Note-taking in UserTesting & FigJam

-

Task & question list

Prototype management

Sampling & recruitment

Session scheduling & setup

Documentation & feedback to design

Literature review

I met with cross-functional research partners to capture perspective and expertise on the source documentation within our shared cross-functional research repository, Sharpr.

User Research

User interviews, contextual inquiry, usability tests, card sorts, surveys, session analyses

Customer Insights

Focus groups, community surveys, fit tests, shop-alongs, home try-ons, market research

Data Analytics

Web data analysis, basket analysis, A/B testing, pre/post testing

Voice of the Customer

Post-transaction surveys, site intercept surveys, customer service logs

Data synthesis

Using Miro, I pulled all research reports pertaining to denim that were published within the past 18 months - a total of more than 30 documents across research teams. Using a color-coded tagging system, I identified descriptive themes and then grouped datapoints speaking to each theme for further analysis. From there, I triangulated datapoints to evolve the themes into key insights, mapping each insight to evidential datapoints and their original source.

The baseline and competitive user tests were instrumental in validating some of our hypotheses, challenging others, and illuminating behavioral phenomena that we hadn’t yet considered. In all, this formative research study gleaned 30+ experience and usability findings that would inform our design strategies — a few samples:

Foundational insights

1

Size & fit confidence

Size & fit confidence (or lack thereof) is the leading driver of low denim category conversion (relative to other categories), and higher rates of return. DTC shoppers often venture to stores to try on before purchase, or purchase multiple sizes with the intent to return the items that don’t fit.

Sources: usability testing, user interviews, A/B testing

2

Denim attribute terminology

Hollister’s denim vocabulary is at odds with how Hollister customers talk about denim. “Fit” is often used as a synonym for style in Hollister brand copy, but customers understand “fit”more as a dimension of size. Similarly, “length” can refer to size length (short/long) and crop (ankle, full-length).

Sources: various qual, VOC surveys, filter usability testing

3

Model diversity

While diversity & inclusion through model imagery humanizes the brand and is received positively as a social statement, inconsistent model attributes can render product comparison difficult on category pages. Model selection can also erroneously suggest a body type that a product is “made for.”

Sources: in-depth interviews, contextual inquiry, VOC

Omnichannel contextual inquiry

With our “known knowns” and our “known unknowns” identified, I developed a research plan with objectives aiming to fill our knowledge gaps. Because the denim shopping process is often an omnichannel experience, I wanted to observe shoppers in both the digital and in-store environment to capture the complete mental model surrounding shopping for jeans, from the beginning of the shopping journey to final purchase. I partnered with the Hollister Customer Insights researcher to conduct a series of in-person interviews coupled with digital + in-store contextual inquiry of the omnichannel denim shopping experience.

Journey mapping

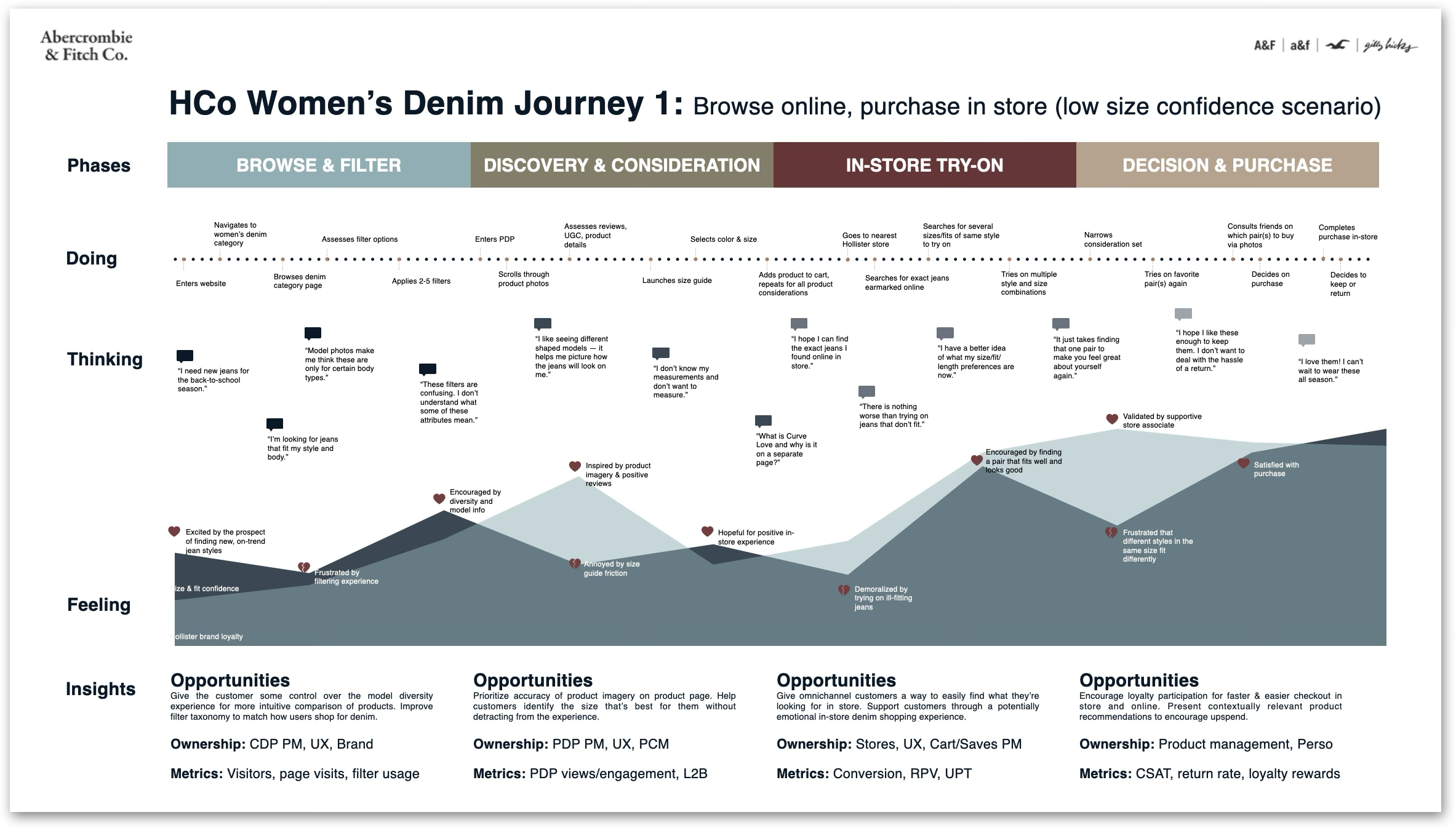

I translated learnings into three research-validated customer journey maps, each representing a commonly observed omnichannel denim shopping experience and its critical business implication.

Browse online → purchase in store (low size confidence)

Browse & purchase online → return in store (high units/transaction, high return rate)

Browse online and in store → purchase online (store availability/extended sizing)

Sample of output; insights have been modified for confidentiality.

Insights delivery

Fulfilling my initial foundational research objective, I produced an artifact that would serve as a source of truth to guide and inspire product and marketing vision and strategy. Findings were socialized across product, UX, marketing, and product channel merchandising, with highlighted key opportunities for customer journey enhancement for each function.

Outcome & impact

This foundational research unified the collective understanding of the Hollister women’s denim shopper and surfaced key opportunities for a $170M must-win category.

By combining mixed-methods research with validated journey mapping, this initiative cultivated the most comprehensive understanding of the Hollister women’s denim shopper to date, arming the brand with the clarity and rigor needed to drive loyalty, affinity, and long-term growth.